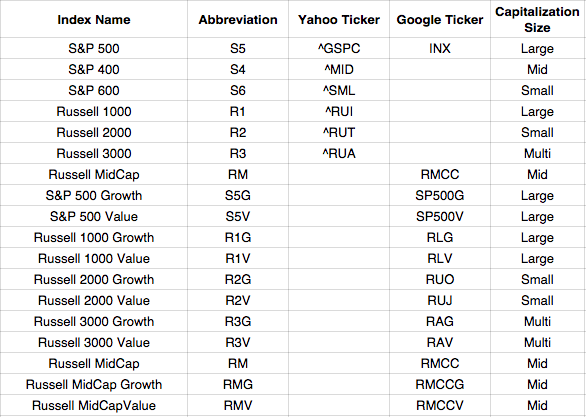

Most people have heard of the Dow Jones Industrial Average or the S&P 500 index. These are just two of the many indices that measure returns for categories of U.S. stocks. The Dow Jones Average is the oldest index, but it is not usually used as a benchmark for measuring fund performance. Unlike the modern indices, the Dow Jones is relatively narrow with just 30 stocks and it is not weighted by market values of its components. The following table summarizes the benchmark indices which almost all funds use as their benchmarks to measure their performance.

The Russell 3000 indices include the largest 3000 exchange listed stocks. This encompasses about 98% of the value of the U.S. equity markets. As such it covers small, mid, and large capitalization stocks.

The terms Value and Growth in the index table refer to investing styles that segment the market according to whether stock prices reflect expectations of rapid growth or not. Stocks with lower prices relative to earnings and growth are categorized as value stocks.

Mutual fund risks and returns are mostly determined by the market capitalization and investment style of the segment in which the fund is choosing stocks – meaning its benchmark index. When choosing an active fund the two main things an investor should be concerned with are the risk of the fund and its return compared to its benchmark index. What we want is positive excess return over the benchmark index return. We will refer to this excess return as alpha.

The most basic measure of risk is the volatility of returns. If we are looking at absolute returns rather than returns relative to an index then we can refer to this as absolute volatility. If we are looking at the volatility of excess returns (meaning alpha which is the fund return after subtracting the index return), this is called tracking error. We can also think of this as alpha volatility.

Overall market risk is measured as the volatility of market index returns. Generally the S&P 500 is taken as representing the overall market. If we take the S&P 500 as the standard index then we can measure everything else relative to this index using a measure called Beta. Thus Beta measures the magnitude of movements of a fund or index relative to the standard index – the S&P 500. Therefore the S&P 500 has a Beta = 1 by definition. An investment with Beta < 1 has less sensitivity to market risks than the S&P 500 whereas a Beta > 1 indicates higher volatility relative to the standard index. The S&P 500 monthly return volatility is about 16% annualized over the last 14 years. All the other indices have higher volatility. The Russell 2000 growth index is highest at 25%. The Beta of Russell 2000 growth index is about 1.24. Risk as measured by volatility and Beta increases as the size of companies (capitalization) gets smaller. Within a size category growth stocks are more volatile than value stocks.