Most of us intuitively understand that you get what you pay for and there is no “free lunch”. Index fund fees are now zero or very close to zero. It sounds too good to be true, so a bit of skepticism is warranted. Low fees are inherently good for investors – but we also have to look a bit closer at the investing process to see what we are giving up to achieve these low fees.

But first let’s acknowledge the low fee advantage. Higher fees at other types of funds necessarily mean they must provide higher investment returns to overcome the disadvantage of their higher fees. But It turns out that index funds also have some built in disadvantages in producing gross investment returns (before fees). One such disadvantage is the adverse stock price impact of changes in the benchmark index. The other disadvantage we’ll discuss here is that index funds are price insensitive: they do not try to buy low and sell high to generate returns.

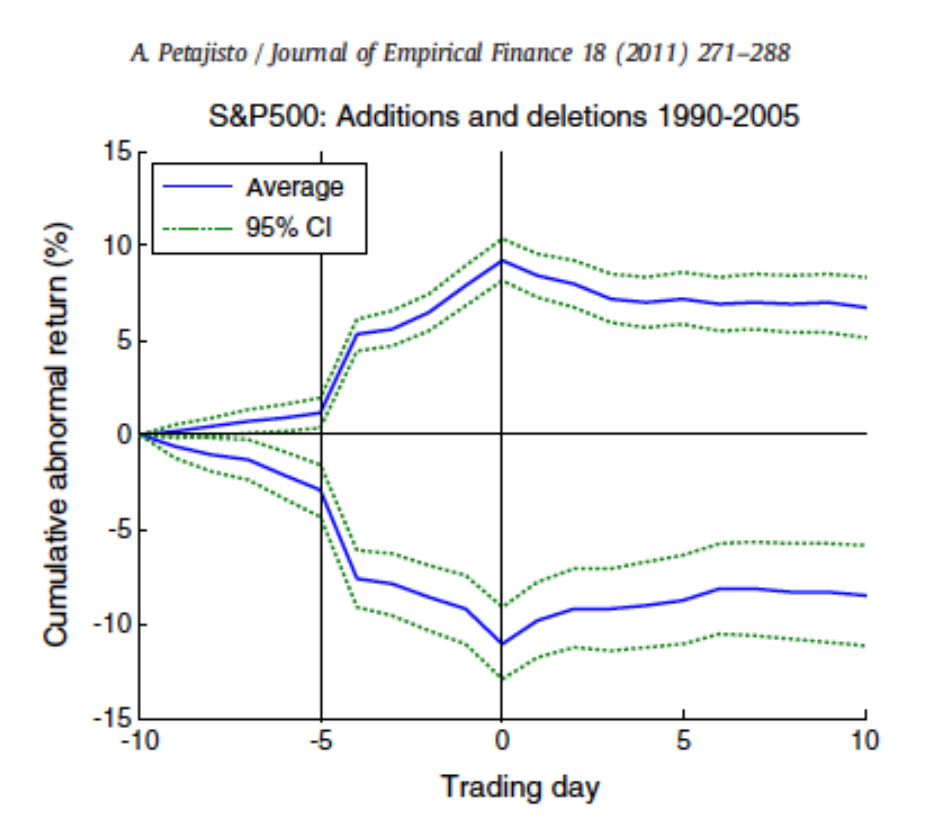

Because index funds must occasionally do trades according to publicized changes in their index, active traders can anticipate and trade ahead of these required trades to drive up the price for buys and drive down the price for sells. These transactions lower returns to the index fund investor but do not show up as costs of the fund. A study in the Journal of Empirical Finance, called “The index premium and its hidden cost for index funds” quantified the impact. The graph below (from the study) illustrates the impact on stock prices when stocks were added or deleted from the Standard and Poor’s 500 index.

The horizontal axis shows time relative to the date of addition or deletion. The vertical axis is the cumulative return impact of the announcement starting 10 days prior to the effective date of the change. The upper blue line is the average return for additions to the index while the lower blue line is the average return for deletions from the index. The green lines show the “confidence interval” range which is a statistical measure of how accurate the estimated averages are. Looking at the upper blue line, this graph tells us that addition announcements cause stock prices to rise in advance of their inclusion in the index so that index funds pay an extra 8% for a stock compared to the price 10 days before the announcement. Then the stock that was added to the index declines about 1% after the index funds have finished their purchases. The lower blue line shows that stocks being deleted from the index drop by more than 10% in the 10 days prior to the index funds’ sales. After the index fund selling is done, these stocks rebound up about 1-2%.

This study estimated the annual costs to index fund investors at .21% – .28% for the Standard and Poor’s 500 index and .38% – .77% for the Russell 2000 index.

Now let’s look at the impact of investing using a price insensitive method. Index funds are by their nature price-insensitive since their rules for their stock holdings are unrelated to the underlying business fundamentals of the companies they own. For example, most index funds are capitalization weighted. This means the stocks are owned in proportion to how much each company is worth so that the largest companies have the most weight in the index and small companies have the least. In contrast, professional investors seek to buy (more) when a stock is cheap and sell when it is expensive. Here’s a quote on this topic from Warren Buffett, one of the most successful investors of our times:

“Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

If price does not equal value, this implies stocks are mispriced. In the real world this happens regularly: stock prices are much more volatile than changes in business fundamentals. Because index fund portfolio weighting is tied to price, they will have higher weights on stocks that are over-priced and lower weights on stocks that are under-priced. This will produce lower returns when pricing errors subsequently reverse as compared to a weighting scheme that does not weight holdings by price.

To illustrate the impact on a capitalization weighted index of mispricing reversals, we can compare its performance to an equal weighted index. An equal weighted index fund is still price-insensitive investing because it does not consider business value. Regular rebalancing of an equal weighted index does, however, require that stocks positions be sold down as their relative value goes up and vice versa so as to maintain the equal weights. Therefore if stock A suddenly goes up 5% temporarily and stock B goes down 5%, the equal weight index would sell stock A and buy Stock B. Then, if these were temporary pricing errors that reversed themselves, stock A would decline 5% after it was sold and stock B would increase 5% after it was purchased. Thus the equal weighted fund is forced by its weighting scheme to buy low and sell high.

Not all price rises or price declines are pricing errors, but these are common enough to produce a return advantage for the equal weighted fund. A 2011 article in the Financial Analysts Journal, titled “A Survey of Alternative Equity Index Strategies”, compares returns for an equal weighted index for the top 1,000 U.S. stocks to the capitalization weighted Standard and Poor’s 500 index. With annual rebalancing, the equal weighted index out-performed the S&P 500 by 2.31% annualized over the study period of 1964 to 2009. This shows that prices do matter for returns and the mechanical nature of index investing does result in a performance penalty because of their price insensitivity.

Skilled active managers start with a disadvantage of higher costs but if they are price sensitive and truly active they can overcome the passive cost advantage. Unfortunately there are a large number of mutual funds that are not different enough from their benchmark index fund to overcome their cost disadvantage. Thus, the problem for investors is the difficulty of identifying the active managers who can outperform and avoiding the rest. Kazio implements a quantitative method developed by academics to identify these managers.