How do you turn a disadvantage into an advantage? If you’re a large company with plenty of marketing dollars, the answer is clever advertising that takes advantage of human psychology. Thus, large financial company advertising implies that the company size and longevity equals superior products.

How do you turn an advantage into a disadvantage? If you are an individual investor, the answer is – believe in the story the big companies are telling you with their advertising.

There are many cases where large companies have advantages in serving consumers other than just entertaining advertisements. On the other hand there are many services and products where smaller more focused businesses are the better choice for consumers. When it comes to investing, large advertising budgets in no way benefit investors. It is our natural human nature to try to find short cuts to avoid using our scarce attention to figure things out for ourselves, but when investing for retirement, it’s worth thinking about things a little more carefully.

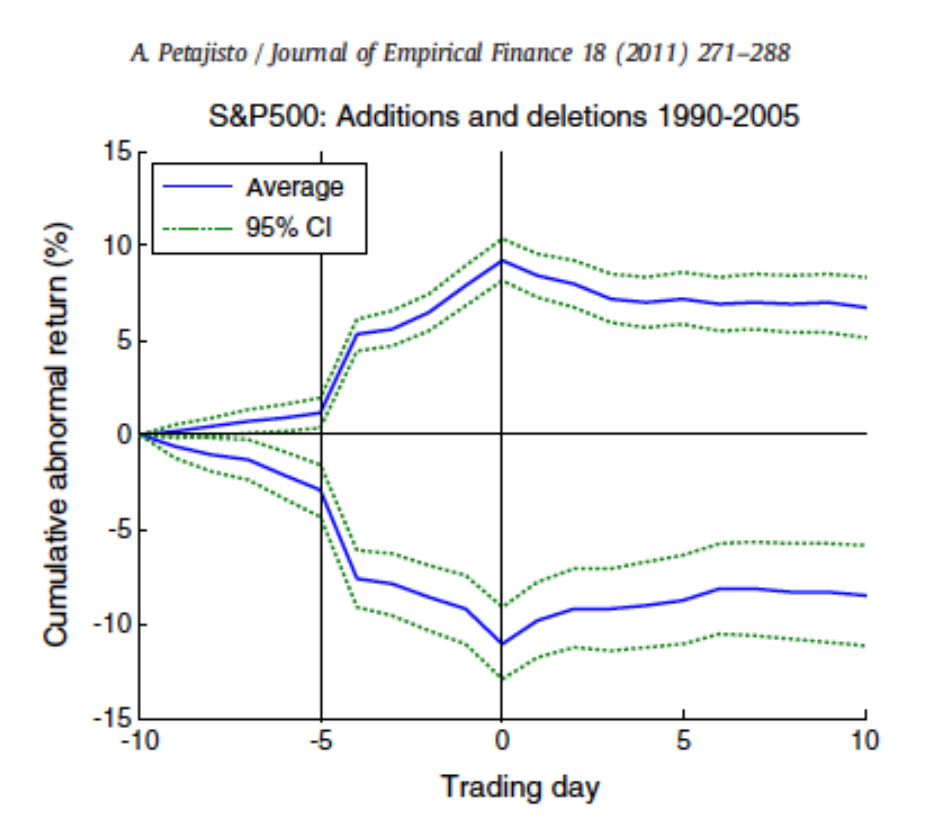

As portfolio dollars grow, trading flexibility declines: it becomes more difficult and time consuming to invest (or divest) a given percentage of the portfolio in any particular security. The market price you see during the trading day is determined by how many shares people (or computers) want to sell and how many they want to buy – and how anxious they are to trade. A large order to buy shares at a given price can exhaust all the sellers at that price for some amount of time (and the same is true of sell orders). Therefore to complete the purchase, the buyer must either increase the buying price to buy from the next layer of sellers who are waiting for the higher price, or, sit tight and wait for more sellers to show up who are willing to trade at the original price. The larger the order relative to normal market volume for a security, the larger the price move required to fill the order quickly, or the longer it takes to wait for enough new sales orders to arrive. If the investor chooses to wait, there is risk that the market may move further against them and they will pay an even higher price or not complete the order.

As a result of the market dynamics described above, an investor with a smaller portfolio will often achieve better buying and selling prices when investing or divesting from a security as compared to an investor trading an equivalent percentage of a larger dollar value portfolio. Alternatively, if the large portfolio investor refuses to adjust the price, they will end up trading a smaller percentage of their portfolio than desired.

It’s clear that we have some advantage here but what is this worth? A research paper titled “Small is Beautiful” published in the Journal of Portfolio Management quantified the advantage of smaller dollar traders versus larger dollar traders. They simulated trading by different portfolio sizes using actual market data combined with similar trading strategies for the funds so as to isolate the size effect. They defined the large portfolio as 20 times the size of the small portfolio. With this magnitude of size difference the smaller portfolio returns were higher by 2% annually. In a market environment where annual returns of 7% are not easy to achieve, this is a huge advantage! Clearly larger portfolios have significant trading disadvantages that grow worse as portfolio size increases. Small is beautiful indeed.

The size of the portfolio also determines the universe of securities that can have meaningful impact on portfolio returns. Warren Buffet alluded to this issue in his letter to shareholders in 1995:

“In the early years, we needed only good ideas, but now we need good big ideas. Unfortunately, the difficulty of finding these grows in direct proportion to our financial success, a problem that increasingly erodes our strengths.”

This is why Buffet tends to buy entire companies when he finds something he likes.

In order to understand this issue, let’s consider an example. In an early 2016 Barrons magazine article, Jeff Gundlach who runs DoubleLine Capital, recommended a small capitalization closed-end fund: Brookfield Total Return Fund. The total market value of this fund is $310 million – a relatively small issue. Here’s what Mr. Gundlach said to Barron’s for their Savvy Investment Ideas article:

“There is no way I could buy these institutionally without the discounts instantly disappearing, because the volume is so low, relative to the amount I would have to buy to make a difference on DoubleLine’s $85 billion in assets. Closed-ends are a good opportunity for the retail investor.”

Let’s do some arithmetic to see what he means exactly. Mr. Gundlach indicated that the fund was at least 10% undervalued. Actually, after the articles came out, the Brookfield Total Return Fund returned 17% over the next 24 trading days. Even if his firm owned the entire fund prior to the article, the total gain in value would have contributed just .06% (= 310MM/83,000MM * 17%) to his firm’s total returns. This is not a meaningful contribution and, as explained in the earlier section, he could not have bought the whole fund without moving the price.

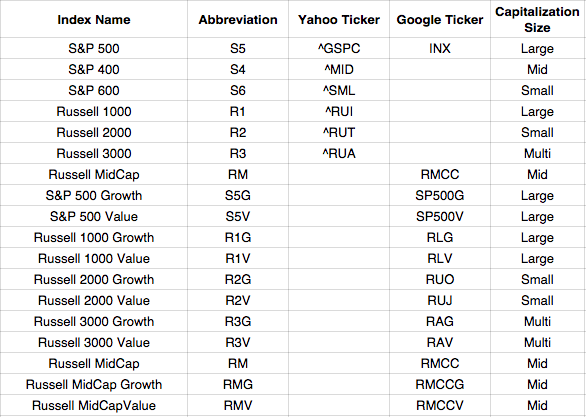

At a more general level, as a portfolio increases in dollar value, the number of securities available in the market that can be accumulated in a meaningful size decreases. For this reason smaller capitalization securities are not as widely followed by institutional investors and these issues can more easily become miss-priced. This provides opportunities to small funds that larger funds cannot take advantage of as a practical matter.

Being Small is Good – but Not Enough

Although smaller funds have an advantage in investing relative to larger funds, in itself this does not guarantee good returns. After all, the fund may be small because a history of poor returns has driven investors away. Only small funds with manager skill are likely to outperform. Fortunately there is an academic research paper which focuses on identifying skilled fund managers, while also estimating the impact of fund size on these managers’ returns. That research paper, written by Martijn Cremers and Ankur Pareek, is called

“Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently”

The authors performed statistical tests to see which fund variables could be used to explain excess fund returns over the fund benchmarks. (Actually they used five-factor alpha which is an academically more rigorous measure of skill). They report statistical regression results which show that Active Share and Duration are strong predictors of excess returns (i.e. alpha). Even after accounting for these skill indicators, returns were inversely related to fund size: out-performance declines as fund size grows larger. For a look at how fund age effects returns, see our post titled: “Are Mutual Funds More Like Red Wine or White Wine?”